Make no mistake about it: at least once in your life you will most likely be a first-time home buyer. And let me be the first to tell you, being a first-time home buyer is not the same as being a first-time TV buyer or a first time computer buyer. This is your house! Where you’ll live a significant portion of your life! Where you’ll make memories, start a family, and depending how long you live there…possibly watch your grandkids!

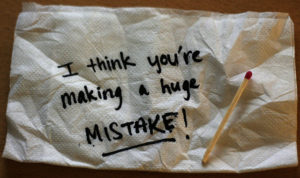

First Time Home Buying Mistakes

Alright, so now that you get the gravity of being a first-time homebuyer, we want to make sure that you don’t make many of the typical mistakes that first-time home buyers make. Here are mistakes you need to learn about as you navigate through this exciting time:

Click to get pre-approved for a home mortgage!

Mistake #1: Looking at Homes That Are Out of Your Budget

If you constantly look at your dream home instead of what you can realistically manage at this current point in your life, you’re doing yourself a big disservice. Firstly, you may taint yourself with thoughts of grandiose properties when all you can afford is a 2 bedroom house. Secondly, you’ll be more likely to stretch your budget to see those luxurious homes, which is not a wise thing to do and can set you up for failure when you’re trying to manage mortgage payments. Don’t look at homes outside of your budget. Be realistic about what you can afford (but feel free to take those luxury house images and pin them to your ‘Future Dream Home’ Pinterest board).

Mistake #2: Not Knowing Which Kind of House You Want

Many first-time home buyers start looking for homes simply based upon their budget. They aren’t sure of the difference between a condo and an apartment or a townhome and a loft. Make sure to do your research and ask your real estate agent what the pros and cons of each type of property is. Also, think ahead about how this house will serve you in your future plans. A condo may be great now, but if you plan on having two kids in the next few years, it may not be the best option to support the growth of your life.

Mistake #3: Being Negligent with your Credit Cards

This is an important one. Credit scores are the be all end all deciding factor in most cases of real estate success and failure stories. Take care of your credit cards and your credit history. That means that when you begin looking at real estate, you want to avoid making any large purchases on your card or cancelling an active card. Both can send up red flags to an inquisitor, which reflects poorly on you and minimizes the chances of you being able to purchase a home.

Mistake 4: Blurring the Lines Between Needs and Wants

This is another big one. Sit down with your husband, wife or yourself and make a list of everything you want in your new house. Now, take that list and determine which items on that list are ‘wants’ and which of them are ‘needs’. A walk-in closet is a want. A washer and dryer hookup is a need. Become clear on the two before you decide on a house that has a lot of great features but becomes impossible to live in because it doesn’t have the basics.

Mistake 5: Not Knowing If You’re Ready to Buy

Ask yourself ‘Am I truly ready to own my own home’. Are you ready to be the chef, the maintenance man, the bill payer and all of the other hats you must wear after you purchase a home. Because once you’re in, you’re in for at least a few years. Take some time to do some serious soul searching before you make your final decision. It will only help you make the best choice for yourself.

Buying a home in Philadelphia or anywhere for the first time can be extremely exciting, but it can also distract you from being truly ready to take the step of being a first time home buyer or home owner. Follow the tips above to make sure you don’t make a mistake during your first time home buying process and know that AGENT LADY, as your dedicated Philadelphia real estate agent, can help you navigate any challenges, questions or concerns you may have.

Photo credit http://bit.ly/1l8WlZ6

About Agent Lady: Cherise Wynne is a leading real estate agent in Philadelphia, helping home buyers and sellers navigate the City of Brotherly Love, with a special focus on first time home buyers. To chat about getting started with your first time home buying experience, click here.