The word “foreclosure” can be one of the scariest things to a homeowner. Unfortunately, it happens more often than one may think. It’s a common term, but do you actually know what foreclosure is or the process of a home going into foreclosure? Agent Lady is here to educate you on just what a foreclosure is and how to get out of it.

What is Foreclosure?

Foreclosure is when the bank takes possession of your home because you have defaulted on your mortgage payments. A common misconception is that the bank is foreclosing on the house itself, but instead they are actually foreclosing on the mortgage or the trust deed. The house is the collateral.

The Process

Missed Payments – The foreclosure process starts when a homeowner misses mortgage payments, or defaults on their mortgage. This can be due to buying a home that turned out to be too expensive, losing their job, or other factors.

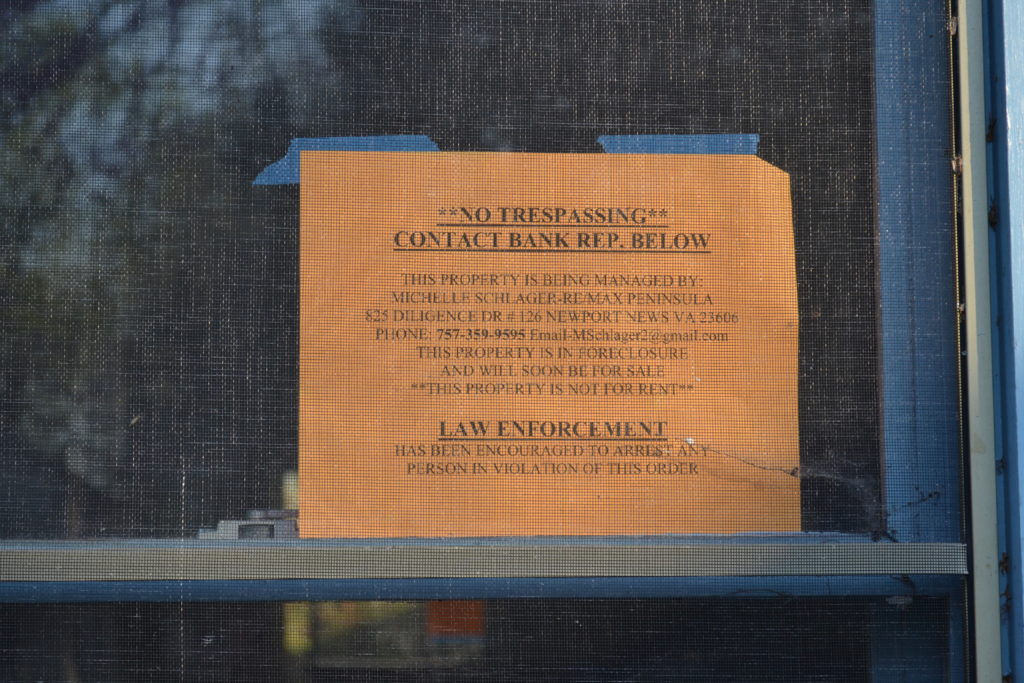

Public Notice – After 3-6 months of missed mortgage payments, there will be a public notice presented to the homeowner. This mostly comes in the form of a notice posted on the front door of the house. This is to make the homeowner aware that the house may be foreclosed on if they do not pay their mortgage.

Pre-Foreclosure – The homeowners typically have a grace period to pay off their debt and end the foreclosure. This can be in the form of a short sale of the house or coming up with the money to pay back their missed payments, plus interest, while keeping their home. Homeowners typically have 30-120 days to pay back their debt.

Auction – Once the bank takes possession of the house, it will go up for auction. At the auction, the house can only be purchased in cash. This is where many investors buy their properties because they typically are sold below the market value. However, the homeowner still has a right of redemption, which means they can still come up with the cash to pay off their debt until the moment it goes up for auction. There is not telling how much time the homeowner has before it goes up for auction.

Post Foreclosure – If the house does not sell at the auction, the bank will then pay for it and it becomes known as a bank-owned property. It will most likely then be sold by a real estate agent to the open market.

Pre-Approval

It’s important to stay within your budget when buying a home and to stay realistic about how much you can afford. You may be preapproved by your mortgage company to buy a $500,000 house, but realistically cannot afford to make those monthly payments while still living the way you are used to.

Click to get pre-approved for a home mortgage today!

Looking to buy a home? Contact the Agent Lady, Philadelphia’s leading real estate agent, so she can put you in touch with a mortgage lender today and get you preapproved!